how are property taxes calculated in martin county florida

Please enter the information below for the current tax year to view and pay your bill. I want to move to Martin County because the taxes are lower.

Desoto County Property Appraiser David A Williams Cfa Arcadia Florida 863 993 4866

Martin County Supervisor of Elections.

. It is understood that estimated Non-Ad Valorem taxes must be added to the estimated Ad Valorem taxes to obtain the full estimated property taxes of the proposed property ie. The median property tax on a 18240000 house is 176928 in Florida. How are property taxes calculated in Lee County Florida.

The maximum portability benefit that can be transferred is 500000. Martin County Property Appraiser. The taxable value is your assessed value less any exemptions.

I get this one seemingly every other day. How Property Tax is Calculated Your property tax is calculated by first determining the taxable value. Property taxes in Florida are implemented in millage rates.

Using this feature you can determine the cost for Deeds Mortgages and other standard documents that we accept. Floridas average real property tax rate is 098 which is slightly lower than the US. Ad Valorem and Non Ad Valorem.

¹ If you need to determine the fees for a document that does not require the collection of Documentary Stamp Taxes leave the field. The Ad VAlorem portion of the tax is calculated basically by multiplying the tax millage rate by the. Martin County calculates the property tax due based on the fair market value of the home or property in question as determined by the Martin County Property Tax Assessor.

3473 SE Willoughby Blvd Suite 101 Stuart FL 34994. Enter 555 Main when trying to locate the property at 555 SE Main Street Stuart FL. The taxable value is then multiplied by your local millage rate to determine your ad valorem taxes.

Registration Title Sales Tax Calculators Hillsborough County Tax Collector. Of the sixty-seven counties in. Martin County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

When searching by address enter street number and street name only. The estimated tax range reflects an estimate of taxes based on the information provided by the input values. Trash drainage taxes or special assessments.

The median property tax on a 50390000 house is 529095 in the United States. To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the County ADA Coordinator 772 320-3131 Florida Relay 711 or. The estimated tax range reflects an estimate of taxes based on the information provided by the input values.

Pay for confidential accounts. Johns Fee Calculator Author. This estimator assumes that the application for the new homestead is made within 2 years of January 1st of the year the original homestead was abandoned.

Enter a name or address or account number etc. There are 2 portions to the annual tax bill. The rates are expressed as millages ie the actual rates multiplied by 1000.

The maximum portability benefit that can be transferred is 500000. The median property tax also known as real estate tax in Martin County is 231500 per year based on a median home value of 25490000 and a median effective property tax rate of 091 of property value. Property tax is calculated by multiplying the propertys assessed value by the total millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The final millage rates are used to calculate the estimated property tax on the proposed property purchase. Our Martin County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Florida and across the entire United States.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Each property is individually t each year and any improvements or additions made to your property may increase its appraised value. How are property taxes calculated in Orange County Florida.

View 2020 Millage Rates. For the full Press Release please click on the Property Tax Deadline button below. This estimator is based on median property tax values in all of Floridas counties which can vary widely.

Martin County Tax Collector. A number of different authorities including counties municipalities school boards and special districts can levy these taxes. The tax year runs from January 1st to December 31st.

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. The median property tax on a 50390000 house is 267067 in Monroe County. Florida Department of Revenue.

Real Property records can be found using the Parcel ID Account Number Subdivision Address or Owner Last Name. The rates are expressed as millages ie the actual rates multiplied by 1000. Combined Tax and Assessment.

Ad valorem taxes are added to the non-ad valorem assessments. The median property tax on a 50390000 house is 488783 in Florida. Shown below we have provided the ability online to calculate the fees to record documents into the Official Record of Florida counties.

The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other taxing authorities set the millage rates. Florida real property tax rates are implemented in millage rates which is 110 of a percent. Property tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

The Martin County Tax Collector Ruth Ski Pietruszewski reminds property owners that March 31 2022 is the last day to pay property taxes for the 2021 tax roll. The median property tax on a 18240000 house is 191520 in the United States. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value.

For a more specific estimate find the calculator for your county. For information on Non-Ad Valorem taxes please call the Martin County Tax Collectors office at 772-288-5600. Loading Search Enter a name or address or account number etc.

34994 Real Property Sales Search. One mill equals 100 per 100000 of property value. Martin County is committed to ensuring website accessibility for people with disabilities.

The big side is the Ad Valorem or according to value portion of the tax bill.

Martin County Property Appraiser Tax Estimator

Martin County Property Appraiser Printable Handouts

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

6621 Se Harbor Cir Stuart Fl 34996 Realtor Com

Martin County Property Appraiser Tax Estimator

Florida Property Tax H R Block

3043 Se Doubleton Dr Stuart Fl 34997 Realtor Com

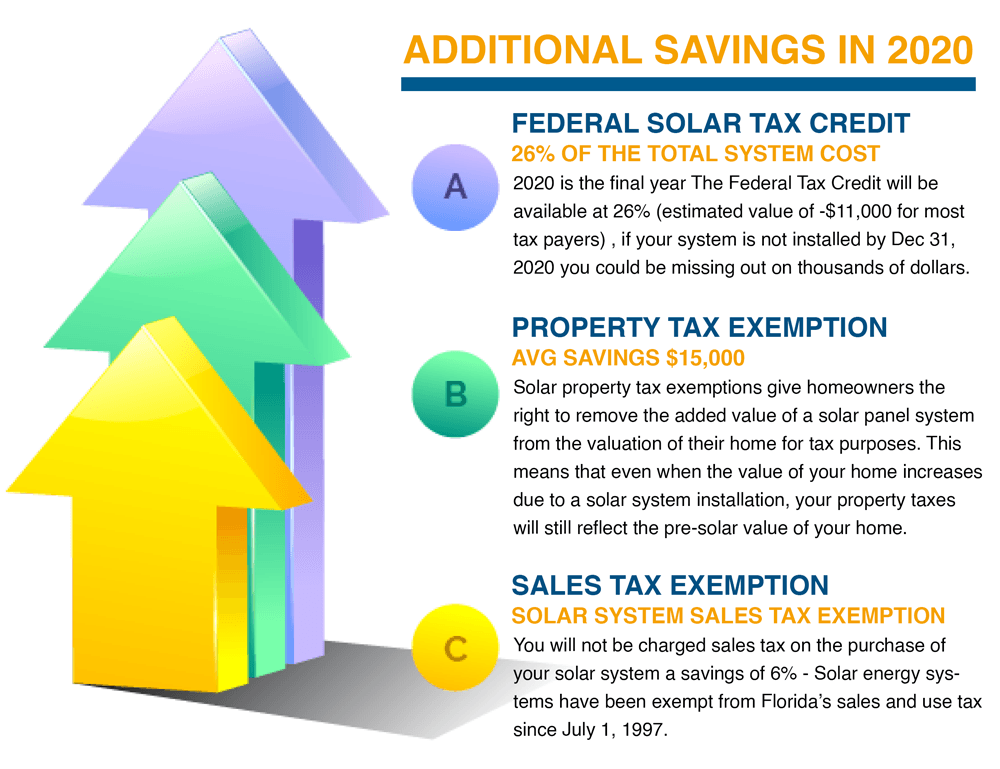

Calculate Your Solar Payback Period Estimate Solar Roi Florida Power Services

Martin County Property Appraiser Tax Estimator

Martin County Property Appraiser Tax Estimator

Martin County Property Appraiser Printable Handouts

What Is Florida County Tangible Personal Property Tax

446 White Oak Lane Lake Barrington Il 60010 Rental 3 Beds 3 Baths Sean And Jill Ryan Ryan And Company Realtors Barrington White Oak Realtors

Martin County Property Appraiser Printable Handouts

Division Of Marital Assets 2022 Florida Divorce Law

Martin County Property Appraiser Tax Estimator